| EDI Recommendations | |

| Invoice/Credit note-1997 | |

1. Introduction |

| Language select: | |

| |||||||||||||||

Preface

The aim of the brochure on hand is to offer documentation describing the exchange of invoicing data between business partners.

The basis of this elaboration is the international standard EANCOM® 2002. The message type INVOIC 010 is used to transmit relevant data. GEFEG.FX (Gefeg mbH, Berlin) was used as the documentation tool.

Please be aware to know that this booklet does not replace the complete specifications in the original chapters or other relevant instructions within the EANCOM® 2002 documentation. Instead, it deals with the description of segments, data elements and codes to be used for a specific task.

The current documentation has been produced by the GS1 Germany GmbH in Cologne. GS1 Germany assumes no liability for any damages incurring from the use of this documentation. This brochure or extracts thereof may only be published or forwarded to third parties with the express written consent of GS1 Germany, which holds copyright on this work.

GS1 Germany thanks all experts who contributed significantly to these guidelines with knowledge from their daily business.

Important note:

To fulfill the requirements of directive 2003/58/EG, article 4, C058 has been opened in NAD segments identifying a message sender. If the place in the 5 DE 3124 is not sufficient, the following RFF segments can be used, qualified with DE 1153 = GN. DE 1154 has got a capacity of 70 digits. Only in those cases, when no RFF segment follows NAD, a RFF+GN can be used in the heading section of the message. Within the EDI recommendations of GS! Germany this is only applicable for the messages REMADV and SLSFCT..

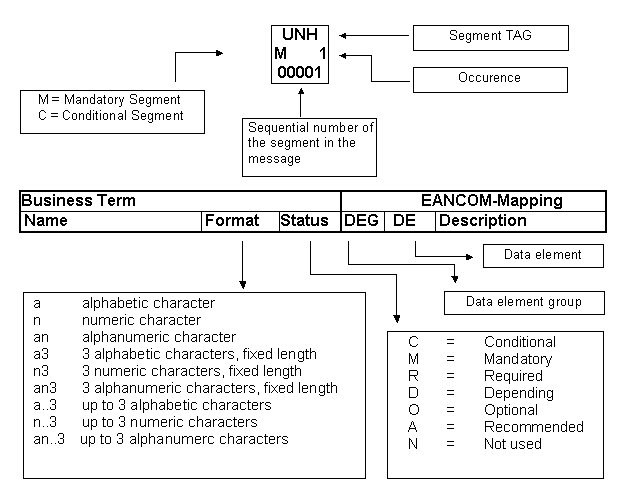

Conventions

This brochure offers different ways to start:

Section 2, "Business Terms", is a table which links directly to the sequence numbers of the segments.

Section 3, "Message Structure Chart", is a list of all used segments in the same sequence as they are defined in the EANCOM® message. In general, for each piece of information one single segment is provided. Exeptions may arrise when the the occurence of a segment is limited and can contain alternative information (e.g., segment BGM).

Section 4, "Branching Diagram", is a hierarchical graphic depiction of all used segments in the same sequence as they are defined in the EANCOM® message. However, every segment is shown only once, and it is therefore possible that the sequence numbering is interrupted.

Section 5, "Segments Description", is a brief summary of the use of each segment.

In Section 6, "Segments Layout", an illustration that has been chosen to match the business terms (data from the inhouse application) with the elements from the EANCOM® syntax.

In Section 7, "EANCOM® Segments Layout", the message is presented in a similar layout as in the EANCOM® manual.

Note on sections 6 and 7:

An additional column (GER) to provide a German status has been added to the layouts. An entry indicates that the recommended status differs from the EANCOM® status. If the recommended status is weaker than the EANCOM® status, the data element (or, if only one term exists the entire segment) can be omitted.

In general, code names are presented in red; these must to be understood as restricted and should not be changed/modified without bilateral agreement with the partner. If codes are given as examples, they are represented in blue (e.g., measurements). In this case, all codes of the relevant code list can be used.

Section 8, "Example(s)", provides at least one message example with comments.

Please note that, for technical reasons, the examples can contain component data element separators, which would otherwise be represented as data element separators in the original messages.

The following conventions apply to this brochure:

Message structure

Heading section

Specification of issuer of invoice, invoicee, invoice date and invoice number.

Detail section

Specification of GTIN to identify goods and/or services, their quantity, price and value.

Summary section

The summary section contains total amounts of the document incl. tax specification.

Notes to EDI recommendations based on EANCOM® massage type INVOIC:

Notes to the detail section:

The detail section is presented in four paragraphs:

Sublines:

Possible combinations:

Invoicing of one article:

o Only 1. Line level, if invoiced unit = consumer unit

Invoicing of one article (package) and indication of contained consumer units

o 1. Line level plus 2. subline

Invoicing of a mixed assortment (package) and indication of contained consumer units

o 1. Line level plus 3. subline (List of items)

Invoicing of the contained items of a mixed assortment (package)

o 1. Line level = delivered quantity, plus 4. subline for invoicing, if articles with different tax rates are contained.

Agreements Detail Section

Free Goods Quantity

Agreements Summary Section

Indication of segment status in “Segment notes”

For all conditional MOA segments within our recommended INVOIC structured messages (UNH DE 0065 = INVOIC), DE 5004 may NOT have a value of zero (0) and must be omitted, unless it is qualified (e.g., taxable value = 0 for non-taxable sums such as donations).

For all mandatory MOA segments within our recommended INVOIC structured messages (UNH DE 0065 = INVOIC), DE 5004 must have a value, even if it is zero (0).

The taxable amount (MOA+125) and the amount of the tax (MOA+124) must be indicated, even if they have a value of zero (0).

Segment group 52 is only used, if the invoice contains more than one tax rate. Every tax rate of the lines must be indicated in one SG52. If an invoice/credit note contains tax-free sums in addition to taxable sums, the summary section of the invoice (and the invoice register message BGM+393, if the use of this message is bilaterally agreed) must contain the corresponding TAX segment in SG52.

Agreements with the German cigarette industry

Allowances/charges in the ALC segment, data element 1230 at message header level:

| VDC10 | = | Waste disposal share |

| VDC100 | = | Invoice discount |

Allowances/charges in the ALC segment, data element 1230 at message header and detail level:

| VDC101 | = | Conveyance discount |

| VDC102 | = | Function/distribution discount |

| VDC103 | = | Direct debit discount |

| VDC104 | = | Quantity discount (loose tabacco in pouches) |

| VDC300 | = | Minimum order charge |

Allowances/charges in the ALC segment, data element 1230 at message detail level:

| VDC200 | = | Line item discount |

| VDC201 | = | Introduction discount |

| VDC202 | = | Scaled discount |

| VDC203 | = | Direct debit discount |

Accompanying documents

Special brochure: Beschreibung der Darstellung von Spenden in der EANCOM® INVOIC (Description of the reprensentation of donations in the EANCOM® INVOIC)

Special brochure: Beschreibung der Darstellung von Münzgeld (Zigaretten-Automatenpackungen) in der EANCOM® INVOIC (Description of the reprensentation of coins in packages of cigarette vending machines in the EANCOM® INVOIC)

Definition of the use of terms

Within the EDI recommendations the following terms are in use:

Delivery note (Lieferschein)

The delivery note is a list with type and quantity of goods delivered to a plant location. The paper document is handed over at the place of goods receipt together with the products.

Proforma invoice (Liefernachweis)

(Electronic) document to the same destination (retailers head office) as the invoice with the content of the delivery note (including or exclusive prices, but WITHOUT VAT amounts).

Consolidation of proforma invoices (Sammelrechnung)

On line level accumulated invoice to merge delivery notes/proforma invoices.

Collective settlement (Sammelabrechnung, Zusammenfassende Rechnung)

Note: By change of the German §14 USTG (Value Added Tax Act) this printed document is no more relevant for tax purposes in Germany.

Total invoice (Summenrechnung)

At line level of the invoice references to other documents are provided which refer to products and/or services.

Invoice register (Rechnungsliste)

Paper document to sum up invoices of one invoicing period and containing control amounts. If this document is requested for organisational purposes, it must be agreed on a bilaterally basis.

| © Copyright GS1 Germany GmbH |